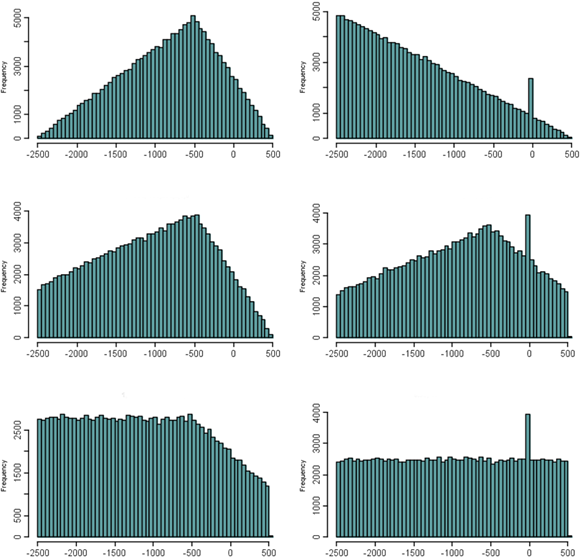

House distribution

antares RiMIS® now offers the possibility to simulate risks and opportunities in addition to the usual distribution functions with a special distribution adapted to practical considerations, which we call "house distribution" due to its characteristic shape.

Specifically, it offers the following advantages:

- Significantly higher flexibility than the common triangular distribution.

- Highly realistic due to weighting factors.

- Optimally adaptable to the respective risk.

Workshop

In addition, the probability of occurrence of the risks can also be specified (global probability of occurrence). If this probability of occurrence is e.g. 10 %, the occurrence of the risk is calculated on average only in every 10th simulation run by means of the house distribution, while in all other simulation runs the simulated value is 0.

Around this topic we offer the practical workshop "Risk aggregation and quantification according to IDW PS 981 & PS 340" for risk managers and controllers. During the workshop you will learn how to:

- Quantitatively describe their risks with suitable probability distributions,

- measure with suitable dimensions,

- Describe dependencies between the risks,

- aggregate by means of Monte Carlo simulation and

- be able to visualise the results.

Our expert Dr Heiko Frings

Dr. Heiko Frings is our expert in the areas of business intelligence, business analytics, quantitative risk analyses as well as in the optimisation of (re)insurance taking. His focus here is on simulations and mathematical methods in the GRC area.